School Lunches

School Lunches at Holy Trinity are provided by Chartwells and are all made on the premises.

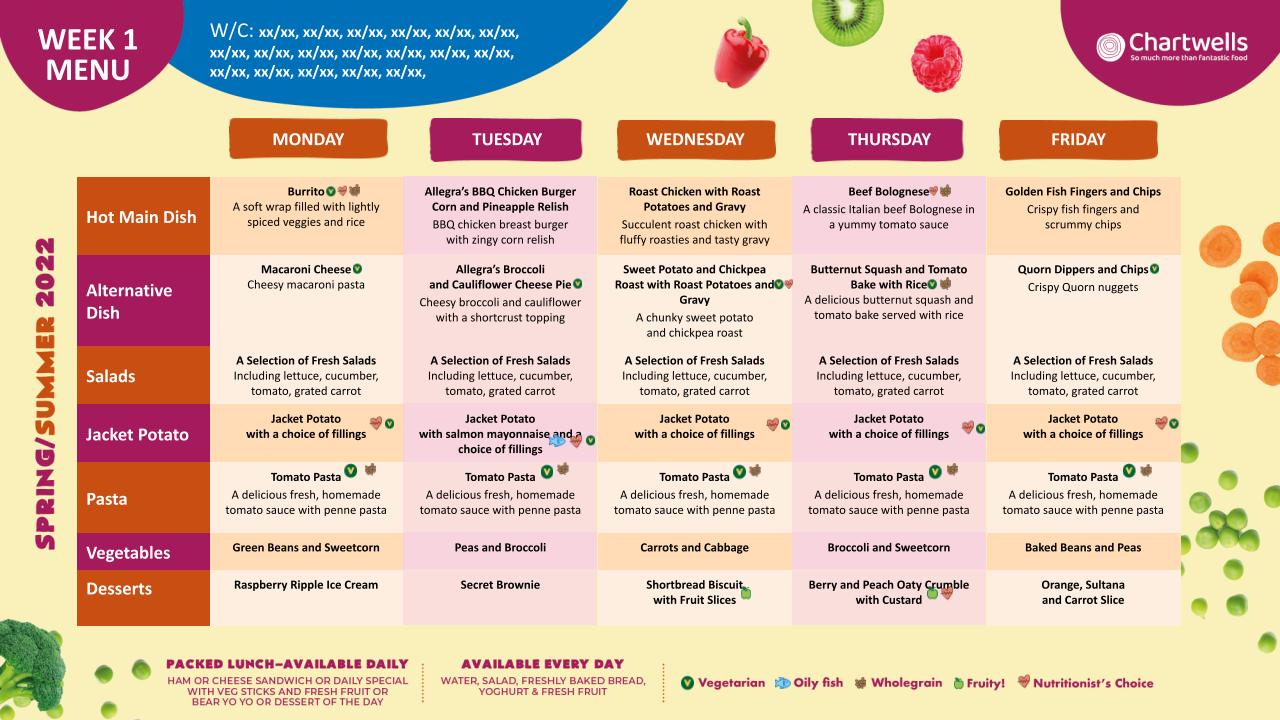

You can see a sample menu below. The current menu is available to view via Scopay when ordering and paying for meals.

As the lunches are being provided externally, we have to provide numbers 48 hours in advance, and there will be no availability on the day.

Meals MUST be booked in advance via Scopay even if you are eligible for free school meals.

Meals are free for Foundation and KS1 children. The cost for KS2 pupils is £2.50-a-day.

If you feel you may be eligible for free school meals please see the information lower down the page, ask at the school office for a form, or apply online via the GOV.UK website.

Free School Meals

If you feel you may be entitled to claim please do so, even if your child/children will bring a packed lunch to school or your child is in Foundation/KS1 and receiving a free school meal anyway. Registering your claim allows our school to apply for additional funding. This money will be used to support your child’s learning in the school environment and help them to reach their full potential by allowing us to fund extra tuition and additional teaching staff.

In order for you to be able to claim Free School Meals and for us to claim this additional funding, we are asking you to provide us with your Name, Date of Birth and National Insurance Number (or asylum seeker reference). It is important to note that no other parents or pupils will know you have been assessed and it will not affect any other benefits you are claiming. All data received will be held in the strictest confidence and only forwarded to the LA for the purpose of assessing school funding.

Do you qualify?

You can register your child for Free School Meals if you get any of these benefits:

- Income Support

- Income-based Jobseeker’s Allowance

- Income-related Employment and Support Allowance

- Support from NASS (National Asylum Support Service) under Part 6 of the Immigration and Asylum Act 1999

- The Guarantee element of State Pension Credit

- Child Tax Credit (provided you are not entitled to Working Tax Credit) and have an annual income of no more than £16,190

- Working Tax Credit run-on

- Universal Credit

If you feel you may be eligible for free school meals please ask at the school office for a form, or apply online via the GOV.UK website.